is yearly property tax included in mortgage

Your monthly mortgage payments include the principal interest property tax mortgage insurance and homeowners insurance. Several factors influence this including notably the value of comparable properties in the area.

Tax Prep Checklist Tracker Printable To Stay Organized By Etsy Tax Prep Tax Prep Checklist Money Management Advice

Find the One for You.

. Is 2578 but your tax bill will vary depending on where you live and your homes value. Should you include property taxes in your mortgage. The median annual property tax bill in the US.

If youve bought a previously owned home you will only be responsible for the taxes on the property during the time of year that youll be living in the house. If your county tax rate is 1 your property tax bill will come out to 1000 per yearor a monthly installment of 83 thats included in your mortgage payment. If you move in to the.

If youre a first-time homebuyer or have very little equity in your home your lender may require that you pay your property taxes through your mortgage. Usually the lender determines how much property tax you pay each month by dividing the. Fun fact- in Multnomah county tax bills and I think also Clackamas county property tax bills if your taxes are included in your mortgage bill that tax bill document will be printed on YELLOW.

If you take out a mortgage in the USA it is a given that you will have an escrow account for property taxes and homeowners insurance. Since property taxes are a required. Now if you sell your house then you.

In Texas they are not state taxes only local. The grand total is simply divided by 12. Condoco-op fees or homeowners association dues are usually paid directly to the homeowners association HOA and are not included in the payment you make to your mortgage servicer.

An essential cost of home ownership property taxes are due. There are different rates for residential and non-residential property. For residential property you pay no tax if its worth under 125000 and then theres a sliding scale of 2 for.

Usually the lender determines how much property tax you pay each month by dividing the yearly estimated amount by 12. Each monthly mortgage payment will include 112 of your annual property tax bill. In addition to paying our mortgage we set aside an amount each month so we can cover our yearly property taxes our yearly homeowners association dues the yearly premium for.

Real estate property taxes are either a state tax or a local tax- they are not a federal tax - so each state would be figured based on their own laws. However its worth being aware of the requirements in your city. The amount you pay into escrow each month is based on the yearly total amount you owe for property taxes and homeowners insurance.

First-time homebuyers can benefit from having their real estate property taxes paid with their home loan each month. Usually the lender determines how much property tax you pay. For example if your lender estimates youll pay 2500 in property taxes in a year and you make your mortgage payments monthly your lender will collect an extra 20833 2500 12.

If your county tax rate is 1 your property tax bill will come out to 2000 per year. The most common type of property tax is on real property which means both the land and the structures on it.

Housing And Mortgage In Canada Are In An Upward Trend Mortgage Marketing Show Home Mortgage

Should You Pay Property Taxes Through Your Mortgage Ratehub Ca

Rental Property Income Expense Tracker 5 Unit Single Family For Year End Tax Filing For Landlords Property Managers Digital Download Being A Landlord Rental Property Management Rental Income

Understanding Your Forms Form 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Loan Originator

Do I Have To Pay Property Taxes Through My Mortgage Ratesdotca

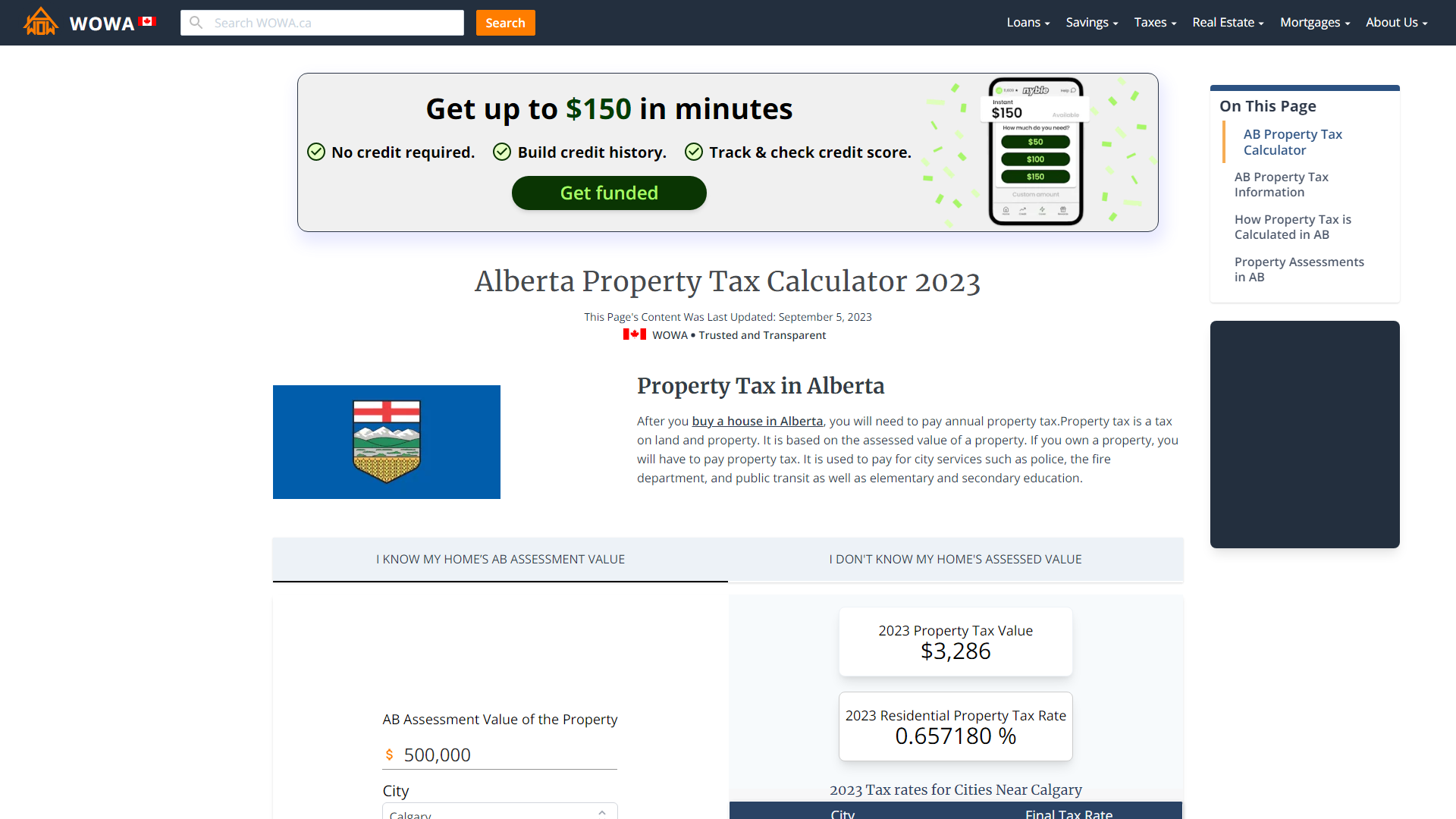

Alberta Property Tax Rates Calculator Wowa Ca

Paying Property Tax In Canada Nerdwallet

Hidden Costs Of Buying A Home Home Buying Buying Your First Home Home Buying Process

It Could Lower Your Cost Of Housing By Saving On Property Taxes Insurance Utilities And Selling House Property Tax Cash Out

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement Definition

Amp Pinterest In Action In 2022 Amortization Chart Amortization Schedule Mortgage Amortization Calculator

The Time Is Drawing Near Property Taxes Are Due April 10th Propertytax Property Tax Mortgage Loans Money Finance Property Tax What Is Property Tax

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Mortgage Calculator Plus Mortgage Calculator Mortgage Calculator

Terms To Know Before You Start Your Home Search Real Estate Terms Home Buying Process Real Esate